Understanding Dividends: A Comprehensive Guide For Investors

Dividends are a crucial aspect of investing that every investor should understand. They represent a portion of a company's earnings that is distributed to its shareholders. This guide will delve into the world of dividends, exploring their significance, types, and how they can impact your investment strategy. Whether you are a seasoned investor or just starting, understanding dividends can enhance your financial literacy and investment success.

In this article, we will cover everything you need to know about dividends, including their definition, types of dividends, and the factors influencing dividend payments. We will also discuss strategies for investing in dividend-paying stocks and how to reinvest dividends for long-term growth. By the end of this guide, you will have a thorough understanding of dividends and how they can play a vital role in your investment portfolio.

Furthermore, we will provide insights into the importance of dividend yield, payout ratios, and the impact of economic conditions on dividends. This knowledge is essential for investors looking to make informed decisions about their investments. Let’s dive into the world of dividends and explore this critical component of the investment landscape.

Table of Contents

- What Are Dividends?

- Types of Dividends

- Importance of Dividends

- How Dividends Work

- Dividend Yield and Payout Ratios

- Investing in Dividend Stocks

- Reinvesting Dividends

- Impact of Economic Conditions on Dividends

What Are Dividends?

Dividends are payments made by a corporation to its shareholders, typically in the form of cash or additional shares of stock. They are a way for companies to share their profits with their investors. Dividends can be an essential source of income for investors, especially those who rely on their investments for retirement or other financial goals.

When a company generates profit, it can choose to reinvest that money back into the business or distribute it to shareholders as dividends. Companies that consistently pay dividends are often viewed as financially stable and less risky than those that do not.

How Dividends Are Declared

A dividend is declared by a company’s board of directors, and it typically includes the following key dates:

- Declaration Date: The date on which the board announces the dividend payment.

- Ex-Dividend Date: The date on which the stock begins trading without the dividend. If you purchase the stock on or after this date, you will not receive the upcoming dividend.

- Record Date: The date on which the company reviews its records to determine which shareholders are entitled to receive the dividend.

- Payment Date: The date on which the dividend is actually paid to shareholders.

Types of Dividends

Dividends can come in several forms, and understanding these different types can help investors make informed decisions:

Cash Dividends

Cash dividends are the most common type of dividend, where investors receive a cash payment for each share they own. This payment is typically made on a regular basis, such as quarterly or annually.

Stock Dividends

Stock dividends involve the distribution of additional shares of stock to shareholders instead of cash. This increases the number of shares owned by the investor but does not change the overall value of their investment.

Special Dividends

Special dividends are one-time payments made by a company, usually when it has excess cash or wants to reward shareholders for a particularly profitable period. These dividends are not part of the regular dividend schedule.

Scrip Dividends

Scrip dividends are offered as a way for companies to conserve cash. Instead of paying cash, the company issues a promissory note to the shareholder, which can be redeemed for cash or additional shares at a later date.

Importance of Dividends

Dividends play a crucial role in investment strategies for several reasons:

- Income Generation: Dividends provide a steady stream of income for investors, which can be particularly beneficial for retirees or those seeking passive income.

- Total Return: Dividends contribute to the total return on an investment, combining capital appreciation with income generation.

- Sign of Financial Health: Regular dividend payments can indicate a company's financial stability and commitment to returning value to shareholders.

- Market Performance: Dividend-paying stocks often outperform non-dividend-paying stocks over the long term, making them an attractive option for investors.

How Dividends Work

Understanding how dividends work is essential for investors. The process typically involves the following steps:

Dividend Payment Process

Once a dividend is declared, the company will follow through with the payment according to the key dates mentioned earlier. Investors must be aware of the ex-dividend date to ensure they are eligible to receive the upcoming payment.

Tax Implications

Dividends are subject to taxation. The tax rate on dividends may vary based on the investor's income level and the type of dividend (qualified vs. ordinary). It’s essential for investors to consult with a tax professional to understand their specific tax obligations.

Dividend Yield and Payout Ratios

Two important metrics for evaluating dividend-paying stocks are dividend yield and payout ratios.

Dividend Yield

Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It is calculated by dividing the annual dividend payment by the stock price. A higher dividend yield may indicate a more attractive investment, but it’s crucial to consider the company's overall financial health as well.

Payout Ratio

The payout ratio is the percentage of earnings paid out as dividends to shareholders. A high payout ratio may suggest that a company is returning a significant portion of its profits to shareholders, but it could also indicate limited funds for reinvestment. A sustainable payout ratio is generally considered to be between 30% and 50%.

Investing in Dividend Stocks

Investing in dividend stocks can be a lucrative strategy, particularly for long-term investors looking for both income and capital appreciation. Here are some key considerations:

Identifying Quality Dividend Stocks

When investing in dividend stocks, look for companies with a track record of steady and increasing dividend payments. Consider factors such as:

- Company's dividend history

- Financial stability and earnings growth

- Industry position and competitive advantage

Building a Dividend Portfolio

A well-diversified dividend portfolio can mitigate risk and enhance returns. Consider investing in various sectors and industries to achieve a balanced approach. Additionally, you can include both high-yield and dividend growth stocks to capitalize on different market conditions.

Reinvesting Dividends

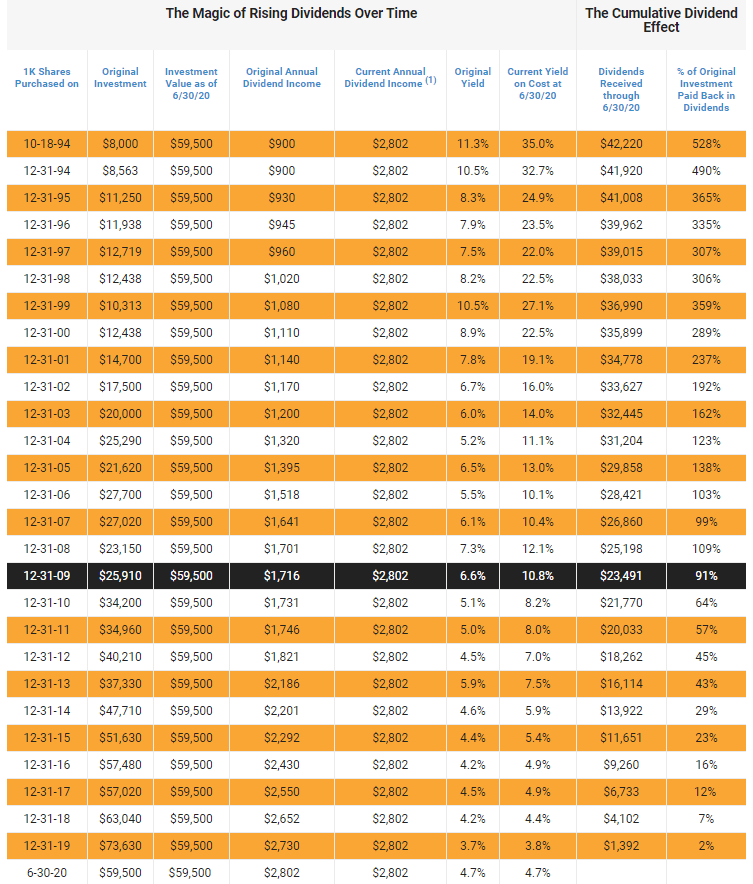

Many investors choose to reinvest their dividends to purchase additional shares of stock. This strategy, known as Dividend Reinvestment Plans (DRIPs), allows investors to take advantage of compounding returns over time.

Benefits of Reinvesting Dividends

Reinvesting dividends can significantly boost long-term investment performance. Benefits include:

- Increased ownership in the company over time

- Compounding growth potential

- Reduced impact of market volatility through dollar-cost averaging

Impact of Economic Conditions on Dividends

Economic conditions can greatly influence a company's ability to pay dividends. Factors such as economic downturns, changes in interest rates, and overall market performance can impact dividend payments.

During Economic Downturns

In times of economic hardship, companies may choose to cut or suspend dividends to preserve cash. Investors should be vigilant during these periods and assess the financial health of their dividend-paying stocks.

Interest Rates and Dividends

Rising interest rates

Understanding Gold Futures: A Comprehensive Guide For Investors

Real Madrid Vs. Atlético Madrid: A Fierce Rivalry In La Liga

Malcolm Brogdon: The Rise Of A Basketball Star