S&P 500 Historical Returns: Understanding The Performance Of America's Leading Stock Index

The S&P 500 has long been a cornerstone of the American financial landscape, serving as a benchmark for investors and a reflection of the overall health of the U.S. economy. This index, which includes 500 of the largest publicly traded companies in the United States, offers insights into market trends, investment strategies, and long-term financial planning. Understanding the historical returns of the S&P 500 not only helps investors make informed decisions but also provides a comprehensive view of market dynamics over time.

In this article, we will delve deep into the historical performance of the S&P 500, examining key trends, significant market events, and how these factors have influenced returns over the years. Whether you are a seasoned investor or just starting out, grasping the nuances of S&P 500 historical returns is crucial for building a robust investment portfolio.

We will also explore the implications of these returns on investment strategies, risk management, and financial planning, ensuring that you have a well-rounded understanding of this essential index. Join us as we navigate the intricate landscape of the S&P 500 and discover what its historical returns can teach us about future investment opportunities.

Table of Contents

- 1. What is the S&P 500?

- 2. Overview of Historical Returns

- 3. Factors Influencing S&P 500 Returns

- 4. Analyzing Historical Performance by Decade

- 5. The Impact of Economic Cycles on Returns

- 6. Comparing S&P 500 Returns with Other Indices

- 7. Implications for Investors

- 8. Conclusion and Call to Action

1. What is the S&P 500?

The S&P 500, or Standard & Poor's 500, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is widely regarded as one of the best representations of the U.S. equities market.

Established in 1957, the S&P 500 was created to provide a broad snapshot of the U.S. economy and serves as a key indicator for investors. Companies in the index are selected based on market capitalization, liquidity, and industry representation, making it a well-diversified index.

Investors often use the S&P 500 as a benchmark to measure the performance of their own portfolios, making it an essential tool for both institutional and individual investors.

2. Overview of Historical Returns

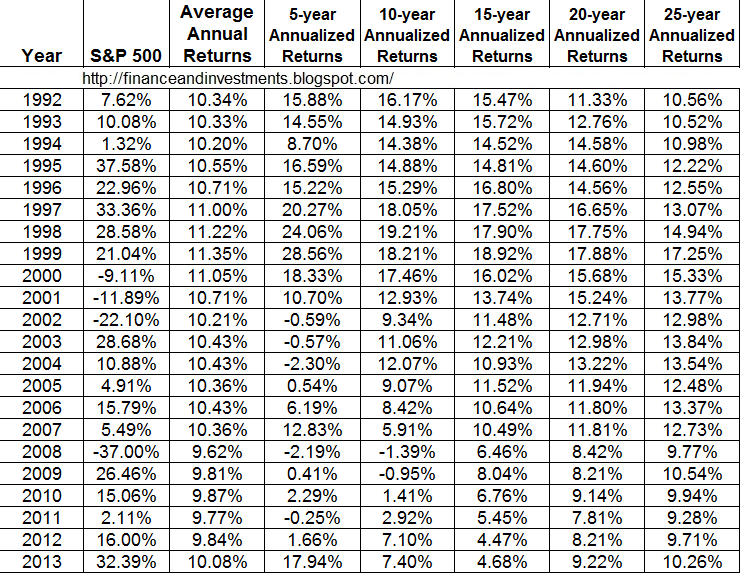

Historical returns of the S&P 500 provide valuable insights into how the index has performed over various time frames. Since its inception, the S&P 500 has averaged an annual return of approximately 10% to 11% when taking into account both price appreciation and dividends.

Some of the most noteworthy historical returns include:

- 1970s: A challenging decade marked by stagflation, with returns averaging around 5%.

- 1980s: A period of recovery and growth, with average returns exceeding 18%.

- 1990s: The dot-com boom led to an average return of nearly 20%.

- 2000s: The burst of the dot-com bubble resulted in negative average returns of about -1%

- 2010s: A strong recovery following the financial crisis, with average returns around 14%.

These historical returns highlight the cyclical nature of the stock market and the importance of a long-term investment perspective.

3. Factors Influencing S&P 500 Returns

Several factors contribute to the fluctuations in S&P 500 returns, including:

- Economic Indicators: GDP growth, unemployment rates, and inflation all play significant roles in determining market performance.

- Interest Rates: Changes in interest rates can impact corporate earnings and investor sentiment.

- Geopolitical Events: Political instability, trade wars, and global crises can lead to market volatility.

- Technological Advancements: Innovations can disrupt industries and create new investment opportunities.

Understanding these factors is crucial for investors looking to navigate the complexities of the stock market.

4. Analyzing Historical Performance by Decade

4.1 1950s to 1960s: The Post-War Boom

The S&P 500 experienced steady growth during the 1950s and 1960s, benefiting from a booming economy and increasing consumer spending. Average annual returns in this period were around 20%.

4.2 1970s: Stagflation and Market Challenges

The 1970s were marked by economic challenges, including oil crises and high inflation, leading to stagnant growth and lower returns averaging 5%.

4.3 1980s: Recovery and Growth

The economy rebounded in the 1980s, characterized by deregulation and technological advancements. The S&P 500 saw average returns exceeding 18%.

4.4 1990s: The Dot-Com Boom

The 1990s were defined by rapid technological growth and the rise of the internet, resulting in average returns of nearly 20%.

5. The Impact of Economic Cycles on Returns

Economic cycles have a profound impact on S&P 500 returns. Understanding these cycles can help investors make informed decisions:

- Expansion: Characterized by rising GDP, low unemployment, and increasing corporate profits, leading to positive returns.

- Peak: Growth slows, and markets may become overvalued, leading to potential corrections.

- Contraction: Economic downturns can result in negative returns, as seen during the 2008 financial crisis.

- Trough: Recovery begins, presenting opportunities for investors to enter the market at lower valuations.

6. Comparing S&P 500 Returns with Other Indices

When evaluating the performance of the S&P 500, it's essential to compare it with other indices:

- Dow Jones Industrial Average (DJIA): Comprising 30 large companies, the DJIA often shows different returns due to its limited scope.

- NASDAQ Composite: Heavily weighted towards technology stocks, the NASDAQ can exhibit higher volatility and returns.

- Russell 2000: Focused on small-cap stocks, this index may provide different performance insights compared to the S&P 500.

These comparisons can help investors understand the broader market context and make strategic decisions.

7. Implications for Investors

Understanding S&P 500 historical returns has significant implications for investors:

- Long-Term Investment Strategy: The S&P 500's historical average returns suggest a buy-and-hold approach may be effective.

- Diversification: Investing in the S&P 500 offers exposure to a broad range of sectors and companies.

- Risk Management: Historical performance can guide investors in assessing their risk tolerance and adjusting portfolios accordingly.

8. Conclusion and Call to Action

In conclusion, the historical returns of the S&P 500 provide invaluable insights into the performance of the U.S. stock market. By understanding the trends, factors influencing returns, and the implications for investment strategies, investors can make informed decisions that align with their financial goals.

We encourage you to explore further, engage in discussions, and share your thoughts in the comments section below. If you found this article helpful, consider sharing it with others who may benefit from understanding the S&P 500's historical returns.

Thank you for reading, and we look forward to seeing you back on our site for more insightful financial content!

The Comprehensive Guide To VHT: Understanding Its Importance And Applications

Bucks Depth Chart: Understanding The Milwaukee Bucks Roster Dynamics

Understanding The Scorpio Zodiac Woman: Traits, Characteristics, And Compatibility